A cloud-based HRMS to facilitate your human resources.

Streamlining HR processes so you can focus on your people!

- No Credit Card Required

- Onboard in 2 Minutes

Upcoming Birthdays

Coming 7 days

Lisa D’Souza

28 July 2023

Lilly Smith

27 July 2023

Carl William

26 July 2023

Upcoming Birthdays

Coming 7 days

John doe

29 July 2023

Lisa D’Souza

28 July 2023

Lilly Smith

27 July 2023

Schedule Assigned To

A cloud-based HRMS to facilitate your human resources.

Streamlining HR processes so you can focus on your people!

- No Credit Card Required

- Onboard in 2 Minutes

Upcoming Birthdays

Coming 7 days

John doe

29 July 2023

Lisa D’Souza

28 July 2023

Lilly Smith

27 July 2023

Carl William

26 July 2023

Upcoming Birthdays

Coming 7 days

John doe

29 July 2023

Lisa D’Souza

28 July 2023

Lilly Smith

27 July 2023

Schedule Assigned To

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

Eaz-ing it for you and your people!

An HRMS that understands the workforce diversity in the Gulf region.

We have meticulously designed each feature, keeping in mind the responsibilities of HR teams, especially in organisations with multiple locations and varying work schedules.

Onboarding

Employee Records

Holiday

Total Leaves

25

- Annual Leaves

- Sick Leaves

- Casual Leaves

Time & Attendance

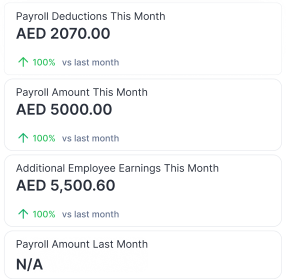

Payroll

Onboarding

Employee Records

Holiday

Total Leaves

25

- Annual Leaves

- Sick Leaves

- Casual Leaves

Time & Attendance

Payroll

Solving HR problems that hinder productivity.

Eazio is derived from Eazy, Input, and Output of information. With the goal to optimise HR processes, automate manual tasks, and allow more time for the HR team to focus on employee engagement.

Eaz-ing it for you with the Eazio app.

Launching Next…

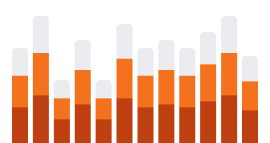

Eazio is launching a series of new features, focusing on Branch Management, Feeds, Performance Management, and Organisational Structure.

Feeds

Branch Management

Performance Management

Organisational Structure

Eazio is free for the first 7 days!

Total Gross Salary

Job Statistics

Let's Connect!

Frequently Asked Questions

Security & Uptime: Eazio works with top-tier platform providers who follow stringent security rules and agree to a Service Level Agreement that assures 99.99% uptime 24/7!

Backup & Recovery: compared to internal IT infrastructures, Eazio’s cloud infrastructure is far more dependable and constant. Your company can gain from a sizable pool of redundant IT resources and a speedy failover mechanism. If a server fails, hosted applications and services can simply be switched to any of the other servers that are still available.

More Frequent Updates: a cloud infrastructure enables us to add new features and improve existing ones whilst causing the least amount of disruption to your regular business activities.

Yes, both the online and mobile versions are available from any location with an Internet connection.

With Eazio, you get the highest security and uptime standards, backed by a 99.99% Service Level Agreement.

Eazio’s cloud infrastructure is more reliable and constant than internal IT infrastructures. You can benefit from a large pool of redundant IT resources. Hosted applications and services can be switched to other servers if a server fails. So don’t worry about your IT infrastructure crashing; it’s like an angel watching over you! Our cloud infrastructure allows us to add and improve existing features more frequently without disrupting your business operations. Mobile and online versions are accessible anywhere with an Internet connection.

Of course! Eazio complies with all UAE payroll and labour laws.

Absolutely! Once you’ve signed up, a team member will contact you to set up your account.

Yes, Eazio does have a mobile application.

Yes, of course! You can integrate Eazio natively with virtually any cloud service.

What are the benefits of a cloud-based solution?

How does a cloud-based solution benefit you?

Does Eazio comply with all UAE payroll and labour laws?

Is it possible to test Eazio before deciding whether to use it?

Absolutely! Once you’ve signed up, a team member will contact you to set up your account.

Does Eazio have a mobile application?

Yes, Eazio does have a mobile application.

Can Eazio be integrated with other systems?

Yes, of course! You can integrate Eazio natively with virtually any cloud service.